Business Car

Car

Car Refinance

EV Car

Jet Ski

Boat

Business Boat

RV

Caravan

Motorhome

Camper

Truck

Plant & Machinery

Equipment

Cash Flow

Fit Out

Loans Made Easy

Same day approvals!

- Excellent rates nationwide

- Digital application process

- Won’t effect your credit score

Why Our Car Finance Stands Out!

We provide customers and businesses with smart finance solutions suited to their short and long term needs.

Traditional Banks

- Hidden fees

- Slow paper application

- Complex surveys

- Outsourced team

- Unclear advice

Verified Lending

- Fast digital application

- No hidden charges

- Same day approvals

- 1on1 consultant

- 24/7 support

- Tailored options

About Us

Established by two young Australians, Verified Lending is committed to revolutionizing the lending experience. Our mission is to offer transparent and straightforward finance solutions for consumers and businesses in today’s dynamic economy.

With a focus on speed and transparency, we provide a comprehensive one-stop solution for all asset financing needs.

Our unique online application process ensures a quick and credit-friendly experience, with same-day approvals. At Verified Lending, we work for you, crafting tailored loan solutions to meet your short-term needs and set you up for future lending success.

Start your loan journey with us in just a few minutes!

Our Simple 4 Step Process

Simply fill out our online application, and you’ll receive a response in minutes. Apply now and let us make your car loan journey a breeze!

01

Apply

questionnaire.

02

Upload

Upload files easily from any device.

03

Option

Our system will Smart Match your application with the best market options suited to you.

04

Approval

Approved and ready to get on the road with your new vehicle!

Common Car Loan Questions

We provide customers and businesses with smart finance solutions suited to their short and long term needs.

ABOUT

Our mission at Verified Lending is to empower consumers by making it simple to locate and evaluate the finest loan options available.

We aim to be the most cutting-edge financial technology company and support openness in the loan process.

In contrast to conventional credit organisations, we won’t leave you hanging. You’ll have a comprehensive grasp of the rates and conditions of the loan options that best meet your needs thanks to Verified Lending.

We’ll search for the ideal lending option for you as a team!

Verified Lending’s mission is to help people realise their dreams by providing complete financial solutions. This means we can provide tailored options suited to your needs, helping you create, grow, and enjoy your wealth.

We analyse a panel of over 40 lenders for different loan options, instead of traditional banks who offer a one-size-fits-all strategy with a single lender. This means we are able to find the most competitive auto lending rates suited to your particular scenario.

Once a match is made, one of our teams’ asset finance specialists will be assigned to you as a knowledgeable auto financing broker.

Our streamline digital system ensures you’re kept up to date from the moment you apply, all the way until you’re driving away in your vehicle. Best of all, you’ll have a personalised one-on-one team member who will support you and provide you with tailored options along the way.

Then in order to locate your ideal vehicle, we have now teamed up with Verified Cars to offer a complementary nationwide vehicle finding solution.

This means if you get stuck finding your next car, we can even assist you in finding your next vehicle… best of all with fleet discounts you’ll be saving you money, time and the risk of potentially buying a lemon.

APPLYING

Visit our “apply now” page and enter your information to submit an application for a loan with Verified Lending.

After that, one of our experts will get in touch with you to finish the application process, which normally takes 10 minutes.

We will inquire about your employment background, ongoing living expenditures, and any other debts you could have during this time. This will help us understand the strength of your loan profile, which ensures we are providing you with the best possible loan options.

If you’d like to fast track your application with us please call our direct specialist on this number: (02) 7503 2790

“Small businesses, with aggregated turnover of less than $10 million, will be able to immediately deduct the full cost of eligible assets costing less than $20,000 that are first used or installed ready for use between 1 July 2023 and 30 June 2024.

The $20,000 threshold will apply on a per asset basis, so small businesses can instantly write off multiple assets.

Assets valued at $20,000 or more (which cannot be immediately deducted) can continue to be placed into the small business simplified depreciation pool and depreciated at 15% in the first income year and 30% each income year after that” – Ato.gov.au

To discuss how we the instant asset write off further for financing assets, give the team a quick call to see how we might be able to help – (02) 7503 2790

With over 40 lenders on our finance panel, we’re sure we have a suitable finance option for everyone. From personal to business finance, even poor credit customers needing a second chance – we have flexible lenders who assist you in financing your next asset.

LOAN

The answer is Yes!

Our customers at Verified Lending have access to a large selection of loan options, ensuring that if you’ve had a mark, default or are struggling with your credit score currently – there is a possible lender on our panel for you!

Our team will complete a 360 degree profile analysis, which gives you valuable feedback on your overall profile strength.

We don’t just want to help get you into your next loan, we want to also ensure our solutions set you up for future loans and lending options to come.

At the conclusion of your car loan term, a balloon payment is a sizeable, one-time payment made to the lender.

This means, borrowers simply need to pay interest on a fraction of the loan’s principal in exchange for this lump sum payment. As a result, monthly payments may be reduced. The payment is referred to as a “balloon” since it is much larger than typical monthly payments.

So, depending on the loan period and other variables, the balloon payment may represent a sizeable portion of the car’s original purchase price. Typically this is suited to people with set budgets for repayments, or people who cycle through cars more frequently.

Now, you may ask – how do we pay the balloon at the end if you don’t have the available cash?

There is a refinance option that we offer, which simply rolls your remaining balloon amount into your next vehicle and loan. Or alternatively, our vehicle specialists can help you sell your current vehicle for the best price, in turn allowing you to pay off your remaining balloon.

Asset finance is a sort of financing that businesses utilize to acquire the equipment and assets they require to expand. It typically involves making regular payments for the use of the asset over an agreed-upon time period, thereby avoiding the need to pay the entire cost of the asset up front.

Common asset financing includes, chattel mortgage, operating lease, hire purchase, and novated lease arrangements.

PROCESS

The length of the loan approval procedure will vary depending on your particular situation.

In most situations, we are able to grant same day approvals after receiving the supporting documents for your application.

Some of the positive benefits of using a finance broker include the great relationships they have with so many lenders, this enables them to access the top interest rates available for their customers.

On top of saving you money, the process of applying with a broker will also save you time and protect your credit file. Our team has a soft touch approach, which means we can assess your loan options within minutes without putting multiple hits against your credit file – which would in turn lower your score.

It is understandable why the asset finance sector is one of the main engines of the Australian economy. Asset finance enables large-ticket purchases to be made more easily using asset finance, and you can use the asset while making payments. You don’t have your money tied to a big purchase whose value may be declining, and the asset security means you pay less in interest and fees.

Verified Lending collaborates with many different asset finance lenders in Australia. Many of them focus on particular industries or types of agreements, which enables us to match tailored options to suit your needs. To locate the finest provider for your company’s needs, get in touch with our team today.

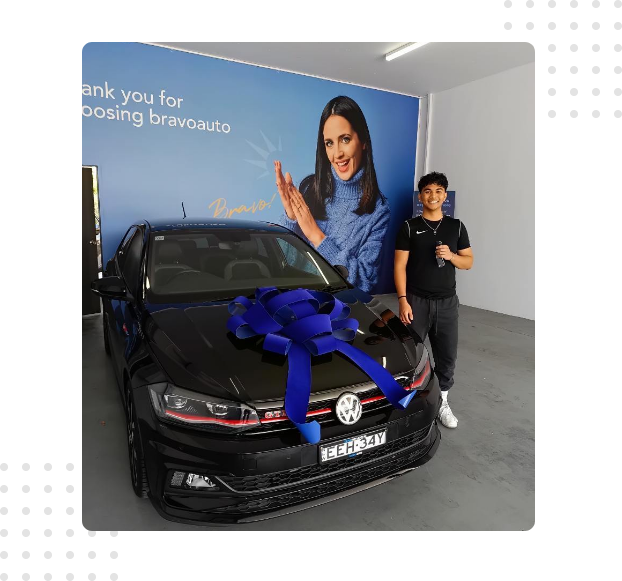

What Our Customers Have To Say...

We value your feedback on our products and services, and strive to improve based on your suggestions, compliments, or concerns. Share your thoughts with us to help us meet your needs better.